| 05-12-2022, 06:12 PM | #6997 |

|

Captain

755

Rep 744

Posts |

Keep the long-term perspective and you'll be fine. If you need the money within a year or two, it has no business being in the market.

Sure the S&P is down 18% YTD, down to 3930 from 4796, but considering that I started buying in when it was 670, and have been purchasing regularly since then, I don't see a reason to make a change. The market goes both up and down, but over time it goes up. I figure there will be 2-3 more recessions before I retire, so no need to jump out the window over this one. |

|

Appreciate

5

|

| 05-20-2022, 05:02 PM | #6998 |

|

Brigadier General

1977

Rep 3,261

Posts

Drives: 2018 BMW 440i GC

Join Date: Sep 2007

Location: Eastern MA

|

Stock mkt going to ping pong until we get inflation print numbers, and if they are hot, the market will tumble, if they are cool, the market will rally on hopes that fed will back off. Its the same game we played last rate hike cycle. It's anyone's guess as to if inflation will be hot, my guess is that it will for several more months, maybe all 2022

|

|

Appreciate

1

Humdizzle6530.50 |

| 05-20-2022, 10:38 PM | #6999 | |

|

Captain

527

Rep 743

Posts |

Quote:

Long term outlook is the key. Market ALWAYS recovered and made all time highs. I just keep adding on red days and know it will reward my account in the long term. Think of this time as “Sale season” |

|

|

Appreciate

2

Humdizzle6530.50 antzcrashing1976.50 |

| 05-21-2022, 01:49 AM | #7000 |

|

Brigadier General

6531

Rep 3,849

Posts |

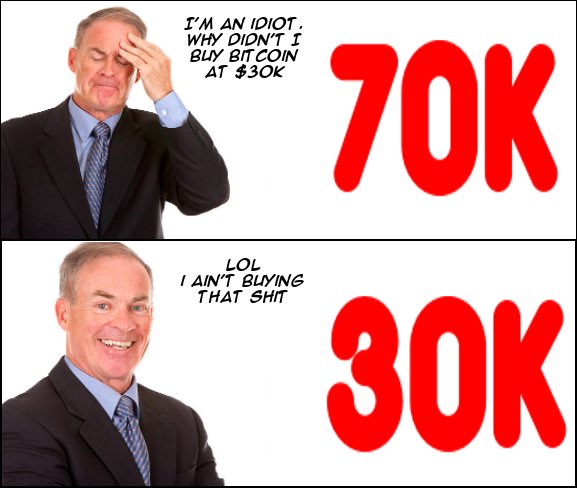

i know this isn't a crypto thread but the same logic applies. nobody wants to buy when there is panic. then they kick themselves on the ATH

|

|

Appreciate

2

antzcrashing1976.50 2000cs3949.50 |

| 05-21-2022, 07:13 AM | #7001 |

|

Fleet Mechanic

13320

Rep 1,979

Posts

Drives: E86 3.0si

Join Date: Oct 2011

Location: Susquehanna Valley

iTrader: (0)

Garage List '19 VW Golf R [10.00]

'55 Ford F100 [0.00] '08 Z4 3.0SI [8.50] '66 Triumph TR4A [0.00] '85 Corvette [0.00] '64 Corvette [0.00] '68 Triumph GT6 [9.50] |

I know this isn't a bond thread, but as of May 1st, the inflation linked series "I" bonds are now paying 9.62%.

https://www.treasurydirect.gov/indiv...nds_glance.htm |

| 06-10-2022, 11:40 AM | #7002 |

|

e90noob

1612

Rep 1,881

Posts |

i learned an expensive lesson

this is probably obvious to everyone but don't put money into the stock market if you need it in the short term i threw some of the house down payment money into investment account a year ago trying to catch some of the gains from the market instead of letting the money sit in a savings account at just 0.25% interest initially was up 10% but now overall lost about 30%+ we are closing escrow on our new home so i had to sell off most of the investment account holdings at major losses i got greedy i thought i'd just make a quick hit and run market said nope

__________________

2008 E90 M3 / LCI trunk + euro tail swap

Production date - 2008-04-22 |

|

Appreciate

4

|

| 06-10-2022, 12:06 PM | #7003 | |

|

Lieutenant Colonel

3542

Rep 1,761

Posts |

Quote:

|

|

|

Appreciate

0

|

| 06-10-2022, 12:58 PM | #7004 | |

|

Private First Class

1322

Rep 135

Posts |

Quote:

|

|

|

Appreciate

0

|

| 06-10-2022, 01:06 PM | #7005 |

|

Private First Class

1322

Rep 135

Posts |

|

|

Appreciate

0

|

| 06-10-2022, 01:47 PM | #7006 | |

|

e90noob

1612

Rep 1,881

Posts |

Quote:

So you can ride it out My losses are realized Going to be eating instant noodles for a year now

__________________

2008 E90 M3 / LCI trunk + euro tail swap

Production date - 2008-04-22 |

|

|

Appreciate

1

Tyga113541.50 |

| 06-10-2022, 01:50 PM | #7007 | |

|

Lieutenant Colonel

3542

Rep 1,761

Posts |

Quote:

Just realize we are all in the same boat |

|

|

Appreciate

0

|

| 06-10-2022, 02:34 PM | #7008 |

|

Brigadier General

1977

Rep 3,261

Posts

Drives: 2018 BMW 440i GC

Join Date: Sep 2007

Location: Eastern MA

|

|

|

Appreciate

0

|

| 06-13-2022, 12:21 PM | #7010 |

|

Major General

3668

Rep 9,783

Posts |

Bloodbath morning. Depending on the rate hikes, this is likely to continue for a while.

|

|

Appreciate

1

antzcrashing1976.50 |

| 06-13-2022, 12:23 PM | #7011 |

|

e90noob

1612

Rep 1,881

Posts |

Did you make money off your prediction?

__________________

2008 E90 M3 / LCI trunk + euro tail swap

Production date - 2008-04-22 |

|

Appreciate

0

|

| 06-13-2022, 12:30 PM | #7012 |

|

Major

2476

Rep 1,143

Posts |

|

|

Appreciate

1

antzcrashing1976.50 |

| 06-13-2022, 12:31 PM | #7013 | |

|

Private First Class

1322

Rep 135

Posts |

Quote:

This is still not a market in which to be taking on a lot of naked risk. Hedging is extremely important. Thank god for those SPY Jul 15 $380 puts that I picked up at the end of may. Savin' my bacon today. |

|

|

Appreciate

0

|

| 06-13-2022, 12:44 PM | #7014 |

|

Captain

3950

Rep 1,003

Posts |

VIX is way up this session, and all indices down but bouncing a bit.

Fed will raise at least 50 bps and market is concerned 75bps this month, then more coming. So “terminal” rate is now much higher than a week ago before the CPI print. 2/10 inverted, a recession signal. But bounced back last I looked. Market now sees inflation having not peaked (may be soon, but not there yet), Fed moving more aggressively, more risk of a real recession (likely we are already in a minor one) or hard landing. So a downer for markets. Market may be overreacting, but there is a possibility this is a bear trigger and we will go down quite a bit before recovering. Fed has to be delicate but fiscal policy will not improve until after mid-terms, and then not likely (if Rs take seats, prez will veto their legislation). Earnings remain pretty good, outlook mostly good; just the value of those earnings (and divs) is declining as rates increase. |

|

Appreciate

1

Hit_Apex3106.00 |

| 06-13-2022, 01:05 PM | #7015 |

|

M3

1439

Rep 725

Posts |

So glad I got out, I took a haircut on BBY at $110 (-6 points), that was the only stock in my trading portfolio at the time. Now it's below $70. I'm waiting with cash on the sidelines. Don't care if I don't time it correctly when it turns. Needs to be way less volatility for me to invest. That's my discretionary account. My employer Roth is taking a beating, 75% of it is in large equities. No sense in changing the mix now, I'm just maximizing contributions and getting the company match, that's a long term play.

|

|

Appreciate

1

antzcrashing1976.50 |

| 06-13-2022, 02:17 PM | #7017 |

|

Major

2476

Rep 1,143

Posts |

I think the bottom is closer to pre-covid numbers - Look 2/18/2020. A big reset.

|

|

Appreciate

1

antzcrashing1976.50 |

Post Reply |

| Bookmarks |

| Thread Tools | Search this Thread |

|

|